Investment thesis compilation and news of the week 01/11/2024

Links to the most interesting investment theses and the notable news of the week. Subscribe to receive it every week!

@JWF211 on GOGO. The company is the leading broadband provider to the business aviation industry (i.e., private jets). is a high-quality, recurring-revenue business with a meaningful growth runway that is grossly undervalued.

- a detalied analysis on the cocoa market, a key ingrediant of chocolate. Delfi and Orion are two traded companies in the sector. Good read about an interesting market.

- on S&P Global. The article is freemium but with the free part you can see why S&P Global is one of the best companies in the world.

- on Rental Car companies (Part 1, and Part 2). Andrew makes a very exhaustive analysis of the industry and its valuation. These companies are quoting very cheap, why? Read the article.

- on Laurent-Perrier, a 200-year-old family-owned premium champagne maker trading at a PE of just ~12x vs his historical multiple of 20x and compared to comparable companies such Davide Campari trading at a PE ratio of ~34x.

@banana_capital_ CTT Correios de Portugal. The business has 4 main parts, postal services, a bank, parcel business and financial servicies. A forgotten business with a trusted brand, that is very well managed trading at EV/FCF 5.9x.

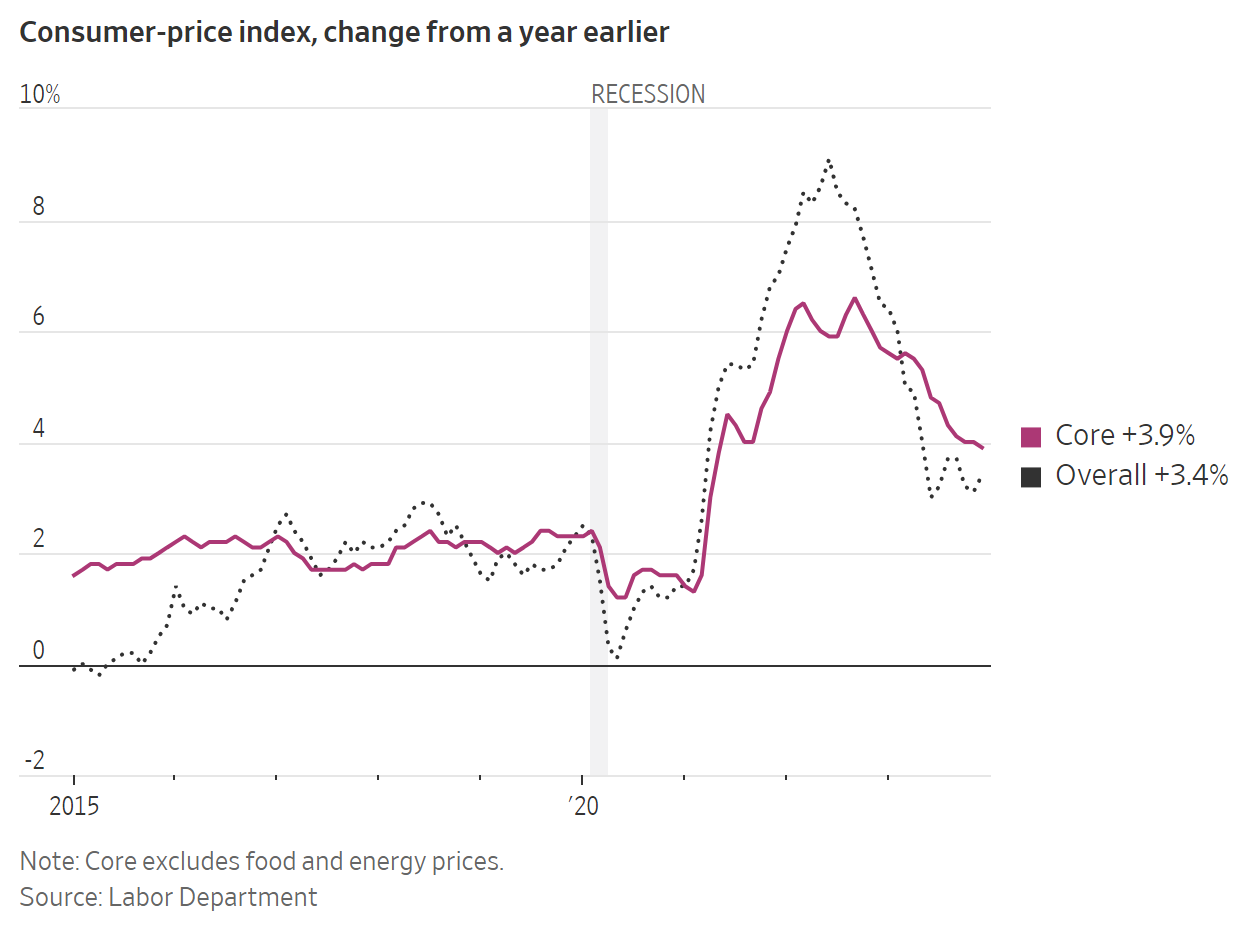

Inflation Edged Up in December After Rapid Cooling Most of 2023

In 2023, Americans experienced a significant improvement in their economic situation as inflation nearly halved, resulting in real wage gains for the first time in three years. The decrease in inflation, though encouraging, has not fully eradicated lingering pressures, as December's data indicates a 3.4% increase in the consumer-price index from the previous year. Inflation-adjusted wages rose by 0.8%, marking a positive shift after two years of decline

.

Despite the notable progress in curbing inflation since mid-2022, concerns persist, and the Federal Reserve is expected to maintain steady interest rates in its upcoming meeting. The hope is for a "soft landing," where inflation is controlled without causing unemployment or a recession. Some price increases persist, particularly in areas like rent, auto insurance, and dentist visits, offset by reductions in furniture, toys, and sporting goods prices.

Although many Americans still express frustration over elevated inflation in recent years, some relief is observed. Falling prices for certain groceries and decreased overall increases have positively impacted household expenses. However, skepticism remains about the sustainability of these reductions.

The Federal Reserve, monitoring a separate inflation gauge, aims to achieve its 2% inflation target. The gauge, the personal-consumption-expenditures price index, is expected to show a modest increase in core prices in December. Most officials suggest that the last rate increase occurred in July, with expectations of potential rate cuts in 2024 if inflation continues to decline.

The decrease in inflation is attributed to normalized factors such as factory production, supply chains, and consumer habits. Americans anticipate a slower pace of price gains in the future, as reflected in a December survey showing a median expectation for annual inflation three years from now at 2.6%, the lowest since 2020.

Despite encouraging signs of declining inflation, some sources of price pressure, particularly in the services sector, persist. Restaurant prices, for instance, increased by 5.2% from the previous year, indicating challenges in certain segments of the economy. Consumer spending remains robust, supported by easing inflation and strong wage growth, raising questions about the speed of disinflation in the near future.

The Securities and Exchange Commission (SEC) has Approved the Taunch of the First Spot Bitcoin Exchange-Traded Funds (ETFs)

The Securities and Exchange Commission (SEC) has approved the launch of the first spot Bitcoin exchange-traded funds (ETFs). Despite SEC Chair Gary Gensler's acknowledgment that the approval doesn't amount to an endorsement of Bitcoin due to its speculative nature, Bitcoin supporters anticipate the new funds will attract tens of billions of dollars into digital assets.

These ETFs provide financial advisors and institutional investors with access to Bitcoin within a familiar investment framework, potentially making it easier, cheaper, and safer for retail investors to buy Bitcoin. The ETFs are expected to start trading soon, and investors should be aware of factors such as fees, which vary among different issuers.

The advantages of Bitcoin ETFs over holding actual Bitcoin include cost-effectiveness and convenience, particularly for small investors who may face high fees and spreads when purchasing Bitcoin directly.

Additionally, ETFs offer the convenience of keeping Bitcoin holdings in the same account as other assets and may be held in retirement accounts, addressing concerns about capital gains taxes. The approval marks a significant development in the crypto investment landscape.

Microsoft Dethrones Apple as the Largest U.S. Company

Microsoft has become the largest U.S. company by market value, surpassing Apple for the first time since November 2021. Microsoft's AI-powered stock rally, driven by the growth of its cloud computing division and optimism about artificial intelligence, brought its market value to nearly $2.87 trillion. In contrast, Apple's market capitalization fell below this threshold, marking a shift in leadership.

Microsoft's revenue is projected to reach around $61 billion in the recent quarter, a 16% growth from the previous year. Analysts expect both Microsoft and Apple to maintain their significance in the market, emphasizing their long-standing presence and ability to adapt over time. Amazon is the only other U.S. company, besides Apple and Microsoft, to have held the title of the most valuable company in the past decade.

Chesapeake, Southwestern to Merge as New Gas Behemoth

Chesapeake Energy and Southwestern Energy have agreed to merge in an all-stock transaction valued at $7.4 billion, creating the largest natural gas producer in the U.S. The deal, at $6.69 a share, values Southwestern at a 2.9% discount to its closing market value of about $7.6 billion.

The combined company, with a market capitalization of over $17 billion, will have a significant position in the Northeast's gas basin and the Gulf Coast's gas-producing region, capitalizing on the booming liquefied natural gas (LNG) exports. The deal signifies Chesapeake's return to its natural gas roots and positions it to become the top natural gas fracker in the U.S.

The transaction is expected to close in the second quarter of 2024. The merger trend in the energy industry continues as companies seek to scale up amid investor pressure.

Focused Compunding, activist open letter to the management.

Bill Ackman interview on activist investing, the economy...

Documentary about Steve Cohen. This guy was the ionspiration for the creation of Bobby Axelrod in the serie “Billions”.

Thanks for mentioning me!